YOUR RETURNS

People invest in real estate to earn passive rental income, realize capital gains from rising markets, or both!

Both rental returns and capital appreciation are important factors to consider when evaluating the potential performance of a property investment. Rental returns provide an ongoing income stream, while capital appreciation provides the potential for long-term growth in the value of the investment.

The return you receive on a rental property, calculated by dividing the yearly rental income by the property’s purchase price. So, if the property is purchased for AED 1M and the rental income generated is AED 80,000, then the rental return is 8%.

The growth in property value over time, measured by the difference between its current value and initial purchase price. So, if a property purchased for AED 1m was sold for AED 1.4m, then the profit of AED 400k over an AED 1m investment would represent a capital appreciation of 40%.

Each time you make an investment, you’re risking your hard-earned money in exchange for potential returns. That’s why it’s important to understand the returns you’re generating on that investment in order to justify the risk taken.

So, here is your full breakdown of all the returns-associated terms you will come across on our platform:

GLOSSARY

Unpacking the Ins and Outs of Your Returns

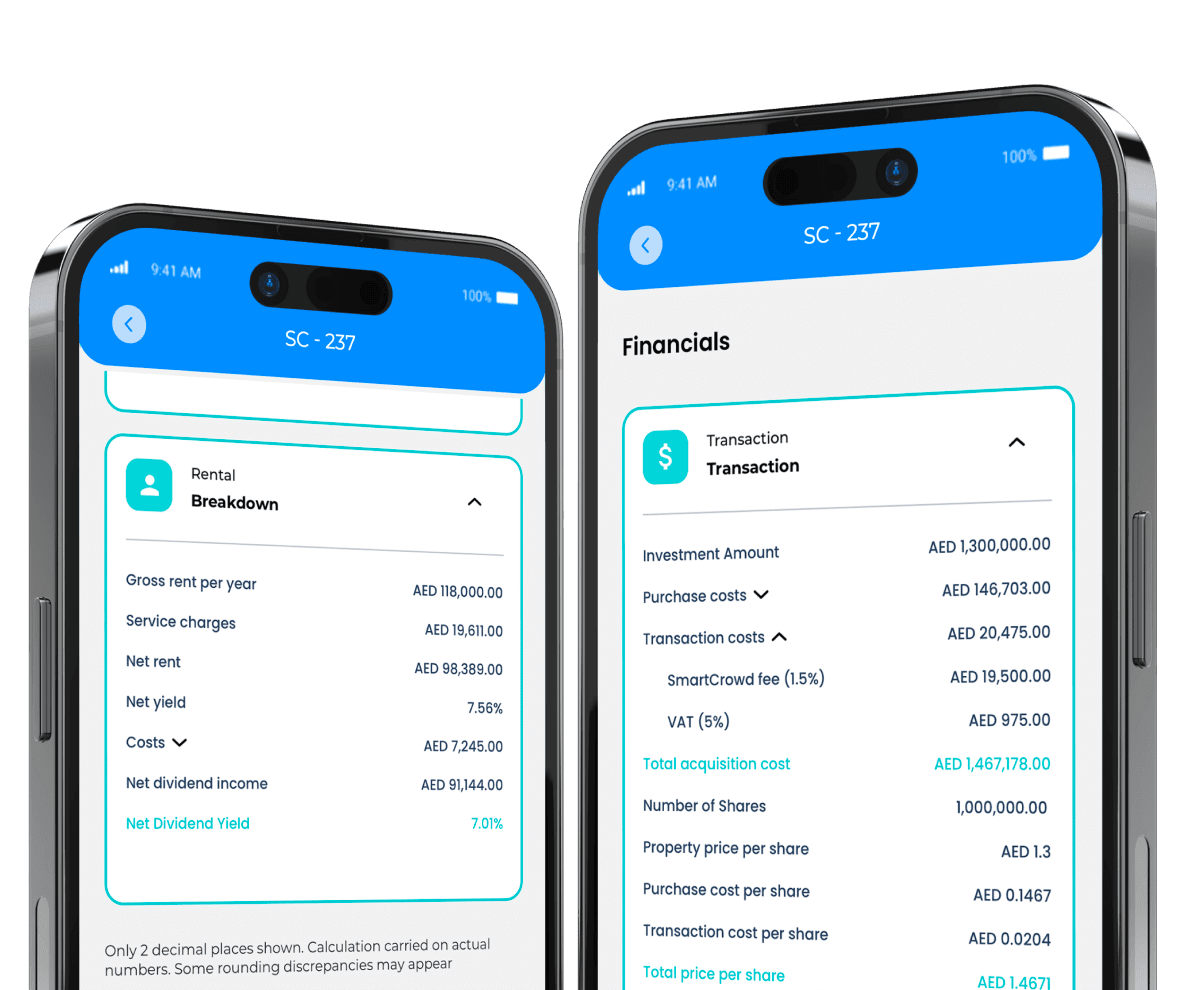

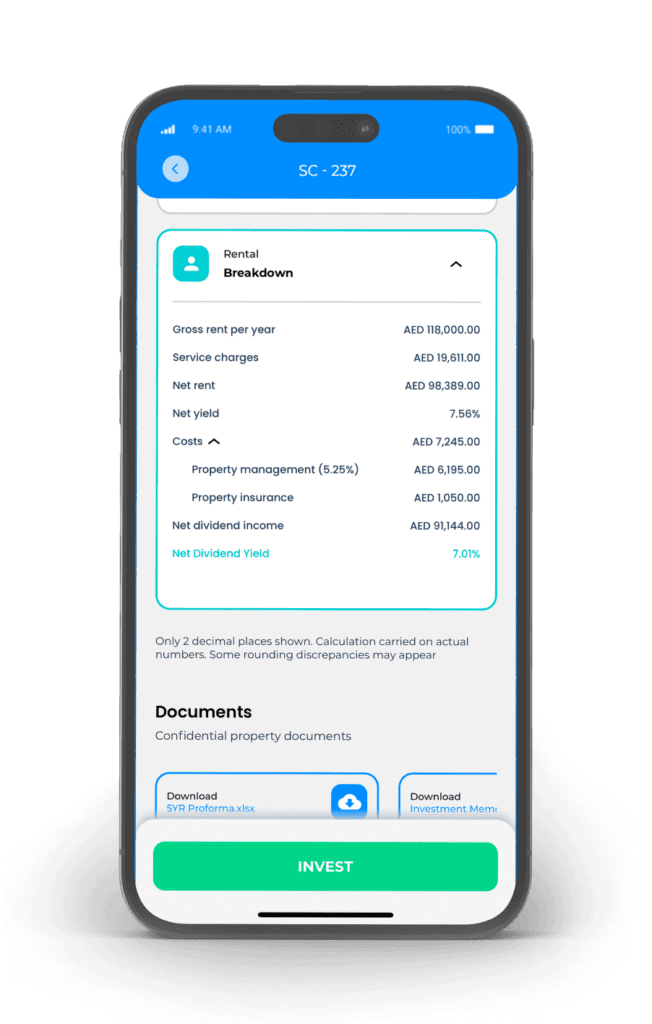

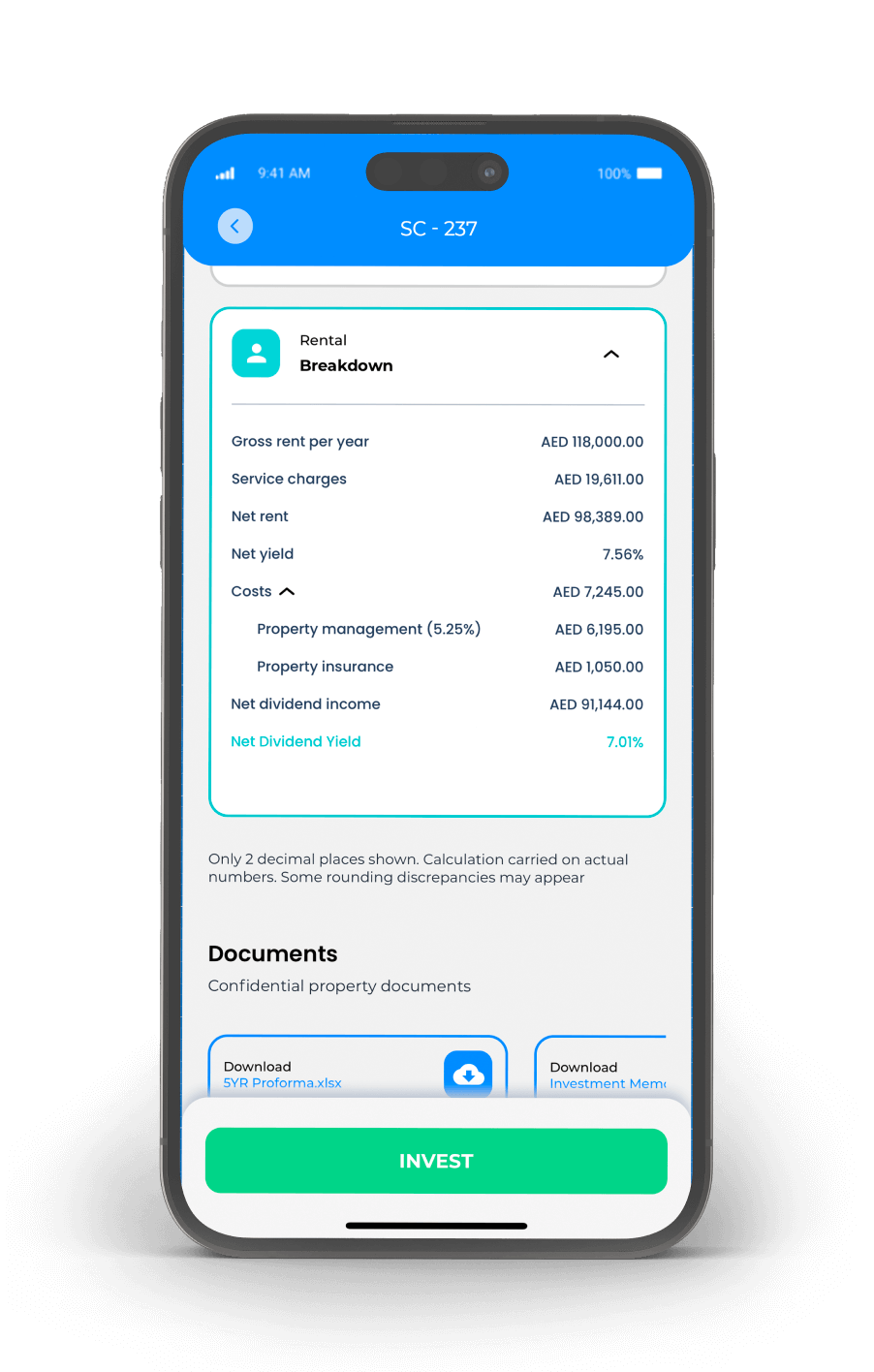

These are all the 3rd party costs associated with completing the property transactions. Details of this can be found on our fees page

This is the SmartCrowd entry fee. Details of this can be found on our fees page.

This is the gross return on your investment. It’s the Gross Rent divided by the Property Price. This is not a true measure of your investment return as it does not include many one-time costs at the time of investment, along with recurring annual costs i.e. service charges.

However gross returns are commonly used in the market to attract unsophisticated investors to make the investment look more appealing than they really are. This is why we want to educate our users so they are well-informed to make better decisions with their hard-earned capital!

This is Gross Rent less annual service charges, but still doesn’t account for other recurring costs such as property management, insurance, etc.

This is Net Rent divided by the Property Price. This is a better measure than gross yield but is still incomplete as some costs are still missing from this calculation.

An annualized total return is the geometric average amount of money earned by an investment each year over a given time period. Now, the holding period of each property is quite varied considering some properties on the SmartCrowd platform have been operational for 24 months, whereas others for only 2 months. The purpose of the annualized return is to demonstrate the return provided on an annual basis hence the term “annualized”.

For example, let’s assume a property purchased for AED 500,000 has been operating for 18 months and has provided a total dividend of AED 80,000 in those 18 months. AED 80,000 over AED 500,000 is 16% but it’s over an 18-month period and difficult to evaluate it against other opportunities. So, we’d like to turn this into an annualized return to calculate the annual return on this investment.

A simple way to do this is to take 16% and divide it by 18 months as that is the period on which this 16% return is derived. This will give us 0.88% per month. This is what the investment has generated on a monthly basis on average. Now, we multiply that by 12 months to arrive at an annual return (0.88%*12) of 10.66%. So, on average, this particular investment is returning 10.66% on an annual basis. Simple enough, right?

This is a measure of an investment’s performance that accounts for all returns (dividend income and capital appreciation) while factoring in costs. To calculate it, first find the total nominal return (net dividend income + realized capital gain), then divide it by the total investment cost. The total return is the final measure of the investment’s success.

Let’s assume a property was purchased for AED 1,000,000 and the Purchase and Transaction Costs were approximately AED 100,000 for a total acquisition cost of AED 1,100,000. This is how much the investor paid for this investment. Now, let’s assume that over 3 years, the property provided a Net Dividend Income of AED 90,000 each year, leading to a total of AED 270,000 for 3 years.

After 3 years, the property was sold for AED 1,300,000, after buying it for AED 1,100,000. In this case, the capital gain was AED 200,000, making the total return AED 470,000 (AED 270,000 + AED 200,000) over 3 years. The total return on investment was 42.72% over 3 years, calculated by dividing the return by the initial investment of AED 1,100,000. This captures all costs and cash returns generated and is therefore the ultimate measure of the investment.

SmartCrowd allows you to start investing in Dubai’s booming property market, build your own rewarding real estate portfolio, generate a passive income, and enjoy remarkable returns. Through SmartCrowd, you can reap all the benefits of direct real estate investments (i.e., by owning the properties) and reduce your risk by allocating your capital across a number of properties all through an award-winning digital platform.

RISK WARNING: Investments in property and unlisted shares carry a risk. Your capital may be at risk and you may not receive the anticipated returns. This is not investment advice. These estimates are based on past performance and current market conditions which cannot be regarded as an accurate indicator of future results. You should do your own due diligence or consult with an independent third-party advisor. Where Investment declines in value or is not repaid, you will still need to meet your repayment obligations. Please review the full set of risk disclosure.

Numbers and returns mentioned are of past performances and not indicative of the current market unless highlighted and promoted as such.

To provide the best experiences, we and our partners use technologies like cookies to store and/or access device information. Consenting to these technologies will allow us and our partners to process personal data such as browsing behavior or unique IDs on this site and show (non-) personalized ads. Not consenting or withdrawing consent, may adversely affect certain features and functions.

Click below to consent to the above or make granular choices. Your choices will be applied to this site only. You can change your settings at any time, including withdrawing your consent, by using the toggles on the Cookie Policy, or by clicking on the manage consent button at the bottom of the screen.