How To Attract Money: Our Top 5 Wealth Building Tips

Do you ever feel like a hamster on a wheel, working tirelessly to make ends meet with no real results? Like most people, you yearn to build wealth and live a financially abundant life without having to worry about money. Yet, the road to wealth seems rough, peppered with bumps, cracks, and obstacles along the […]

Getting Rich Quick: Viable Concept or Alluring Myth?

We all have dreams of getting rich quickly, right? It’s a common aspiration that we all share – getting rich by, ideally, doing absolutely nothing. That way, all our problems would vanish into thin air and everything would be perfect. Truth is, getting rich quickly is like losing 25 kilograms in a day – it […]

Why Building Wealth is more Important than getting Rich?

When thinking of making money, most people confuse the practice of building wealth with getting rich. The two terms are often incorrectly used interchangeably. Building wealth and getting rich may seem similar to you, but they are completely different in the approach. It’s important to understand the distinct differences between them for achieving the right […]

Should You Invest in a Dubai Holiday Home in 2021?

In today’s post, we’re going to lay out the facts to answer the question that’s currently on every real estate investor’s mind: does it make sense to invest in a Dubai holiday home in 2021? Recap: A holiday home is a short-term rental property. Renters (or guests) typically use sites like Airbnb to book these […]

Why real estate?

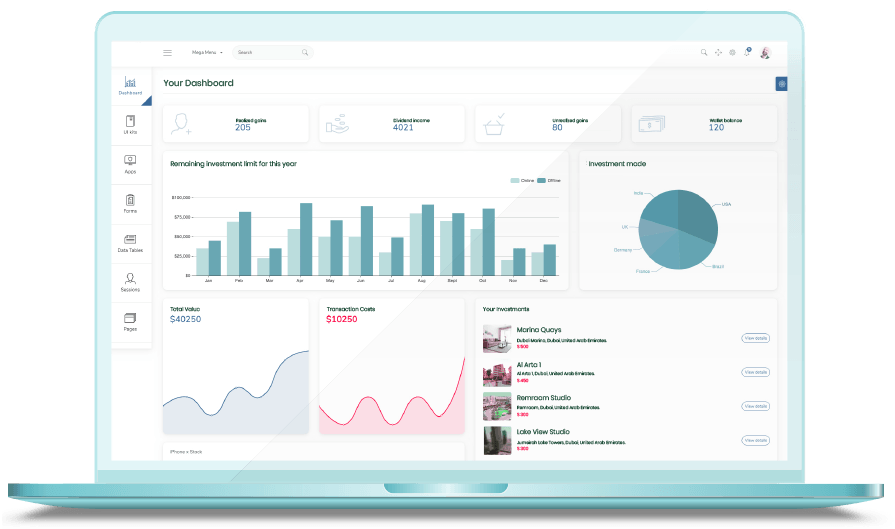

Earn two types of return. One for today and one for tomorrow… If you can afford to invest in real estate, any time is a good time. Timing the market is practically impossible. What do we mean by “timing the market”? Simply, waiting for the ideal and most opportune moment to make an investment. If […]

The secret to wealth creation

When it comes to property investing, the data has clearly revealed that rich people succeed more in earning returns. Whats their secret? Diversification. They simply diversify their wealth across various asset classes. Essentially, rich people have more money; and more money equals the ability to invest in more things. Unfortunately, without access to large funds, […]