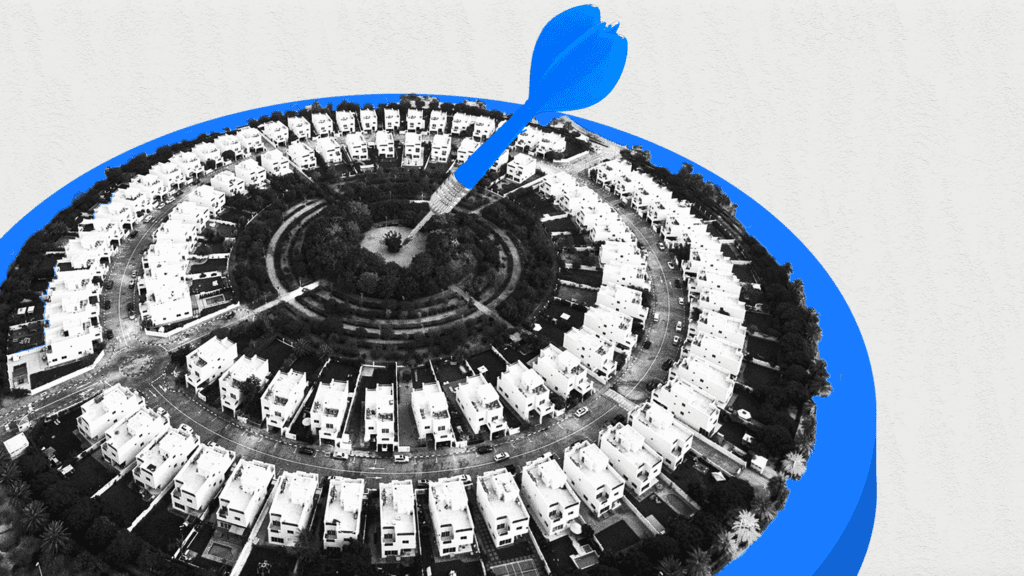

Jumeirah Village Circle, also known as JVC, continues to perform strongly as one of the most sought-after destinations when investing in Dubai. Its appeal lies in offering affordable, family-friendly living right in the heart of new Dubai, making it a top choice for residents and Dubai property investors.

Read on to find out what attracts residents and investors to this Dubai gem.

Why Does Jumeirah Village Circle Stand Out?

What really sets JVC apart is its abundance of world-class amenities, from landscaped parks to top-notch eateries, along with its strategic location. In fact, JVC’s proximity to major highways like Mohammed Bin Zayed Road, Barsha Road, and Al Khail Road makes JVC a commuter’s dream.

Overall, this self-sufficient community ensures a well-rounded lifestyle for all, attracting families and working professionals from all over the world. And, if the local amenities aren’t enough, then the Mall of the Emirates, Dubai Miracle Garden, or the beautiful JBR beach, are just a short drive away.

For Dubai property investors, here’s a quick breakdown of JVC’s latest performance trends, based on the latest data across Dubai real estate (Source: Reidin).

1. A Busy Hub for Sales

Jumeirah Village Circle has maintained impressive transaction volumes, with 10,878 sales transactions year-to-date, making it one of the busiest real estate hubs in Dubai. Dubai property investors are drawn to its affordable prices and attractive rental yields, keeping the momentum strong in 2024.

2. Growing Price Trends

Jumeirah Village Circle continues to stand out for having great value for money in comparison to other prime areas when investing in Dubai. While prices in the area have experienced slight fluctuations, JVC remains an affordable option for both first-time buyers and seasoned Dubai property investors.

This consistent pricing makes it appealing for those looking for long-term capital appreciation when investing in Dubai real estate. Not to mention, JVC’s affordability has positioned it as the go-to choice for more budget-conscious property buyers and investors.

3. High Rental Demand

With rising rents across Dubai and a growing population, JVC has been experiencing strong demand for rental properties, with 14,741 rental transactions recorded. This makes it one of the most active rental communities in Dubai and therefore a highly sought-after location for real estate investors. This high demand also ensures low vacancy rates, providing stable returns for Dubai property investors.

4. Impressive Rental Yields

One of the standout features of Jumeirah Village Circle is its impressive rental yields, with returns hovering around 6.5% to 7.8% in recent months. This strong yield, combined with the area’s affordability, makes it a lucrative Dubai real estate investment option for those seeking cash flow.

5. Why Investors Love Jumeirah Village Circle

On the outside, Jumeirah Village Circle is incredibly attractive due to its connectivity, close-knit community, and convenience. But from a data perspective, Dubai property investors consider JVC a suitable Dubai real estate investment option due to its affordable entry points compared to other Dubai communities, its high rental yields of around 6%, and growing capital appreciation potential.

So, whether you’re settling down or investing in Dubai’s real estate market, JVC offers stability and potential growth. If you’re looking for a chance to secure a property in JVC and earn rental income, then look no further than SmartCrowd. In fact, some of our successful exits have been in Jumeirah Village Circle, which you can check out here!

With us, you can diversify your entire portfolio with various properties located in Jumeirah Village Circle, as well as other prime areas in Dubai, like Dubai Marina, Business Bay – the list goes on. So, why wait? Simply download our app to check out our latest opportunities, make JVC a part of your real estate portfolio, and grow your wealth, the smart way.

Disclaimer: This blog is intended solely for educational purposes and shouldn’t be treated as financial advice. We suggest you always conduct thorough research, perform your own due diligence, and consult with financial advisors to assess any real estate property against your own financial goals.