FEES STRUCTURE

Because fees don’t have to hold you back! We’ve created a fee structure that ensures more money is in your pocket so you can invest regularly in order for you to compound your returns. In fact, only the entry fee is paid by you.

The Annual Administration and Exit Fees are derived from the returns generated. As fees are the biggest killer of your returns, we want to make sure our fee structure allows you to maximize your returns!

Know What You’re Paying For.

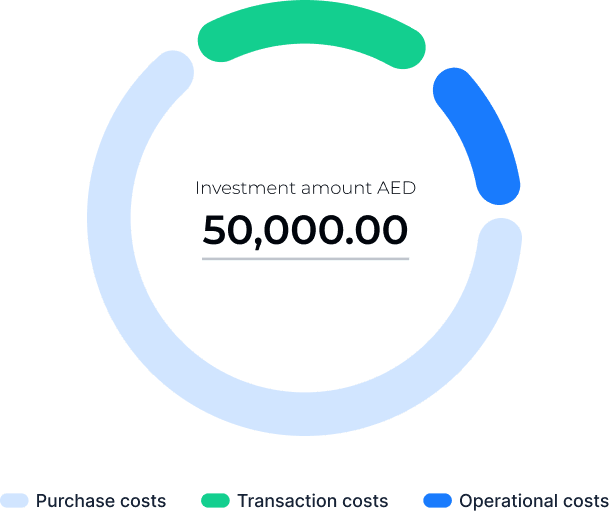

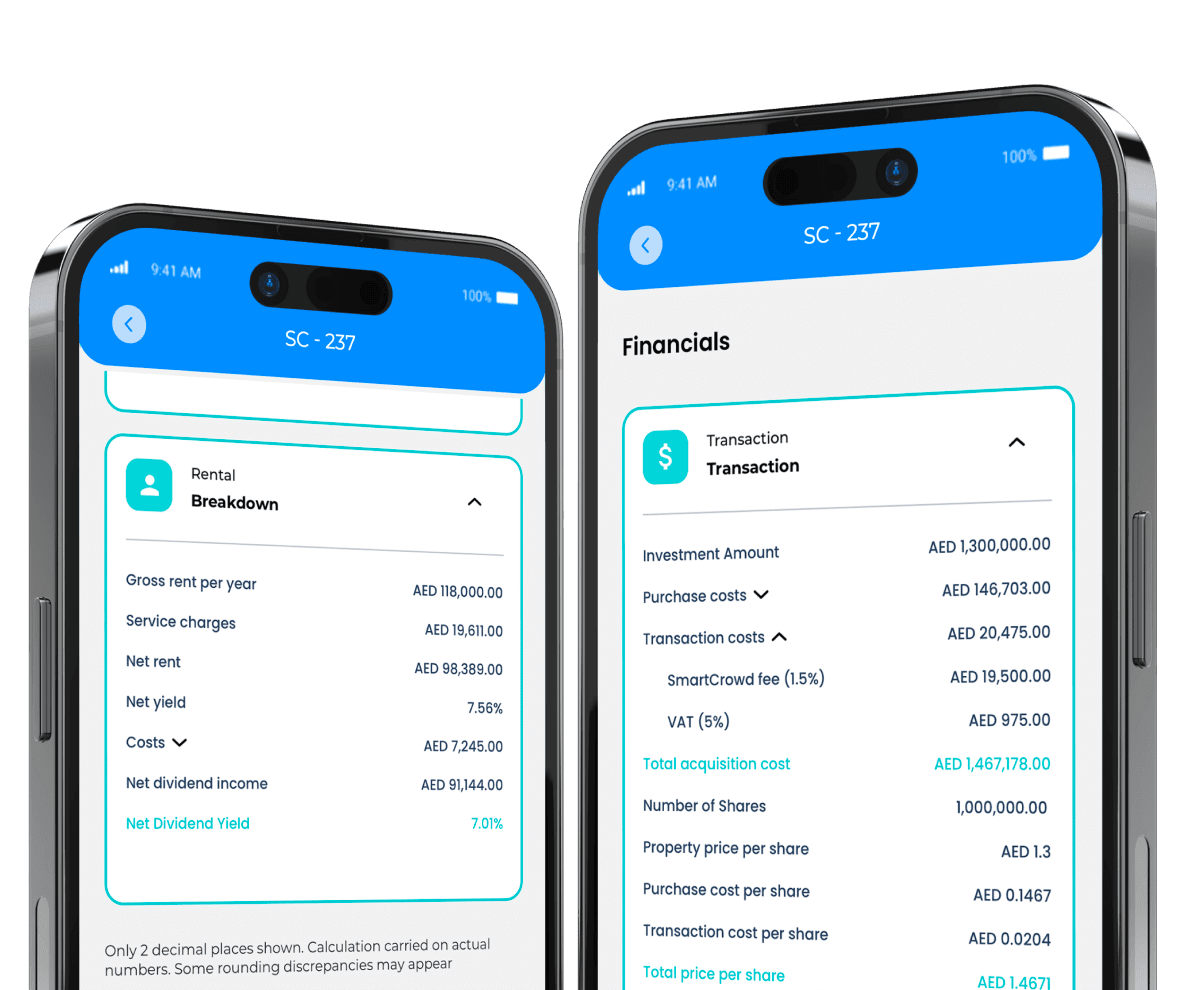

TRANSACTION COSTS

This glossary details all the investment costs in a transparent manner so you know exactly what you are paying for. The following fee structure is for our general buy-to-let investment opportunities which include other 3rd party costs typically associated with property transactions.

TRANSACTION COSTS

There are also ongoing operating expenses that are reflected in the rental breakdown.

We detail those costs below along with the full rental breakdown for your benefit.

This is the property management fee. For long-term rental properties, this is typically 5% of the gross rent or a minimum fee of AED 1,800-2,000 depending on the property. This is in line with market practices.

For short-term rental properties, this management fee can range between 18%-20%. In the market property management for short-term rentals ranges between 15-25%, inclusive of 3rd party operator costs, such as Airbnb, Booking.com, etc.

SmartCrowd allows you to start investing in Dubai’s booming property market, build your own rewarding real estate portfolio, generate a passive income, and enjoy remarkable returns. Through SmartCrowd, you can reap all the benefits of direct real estate investments (i.e., by owning the properties) and reduce your risk by allocating your capital across a number of properties all through an award-winning digital platform.

RISK WARNING: Investments in property and unlisted shares carry a risk. Your capital may be at risk and you may not receive the anticipated returns. This is not investment advice. These estimates are based on past performance and current market conditions which cannot be regarded as an accurate indicator of future results. You should do your own due diligence or consult with an independent third-party advisor. Where Investment declines in value or is not repaid, you will still need to meet your repayment obligations. Please review the full set of risk disclosure.

Numbers and returns mentioned are of past performances and not indicative of the current market unless highlighted and promoted as such.

To provide the best experiences, we and our partners use technologies like cookies to store and/or access device information. Consenting to these technologies will allow us and our partners to process personal data such as browsing behavior or unique IDs on this site and show (non-) personalized ads. Not consenting or withdrawing consent, may adversely affect certain features and functions.

Click below to consent to the above or make granular choices. Your choices will be applied to this site only. You can change your settings at any time, including withdrawing your consent, by using the toggles on the Cookie Policy, or by clicking on the manage consent button at the bottom of the screen.