HOW ARE YOUR

Investments Structured?

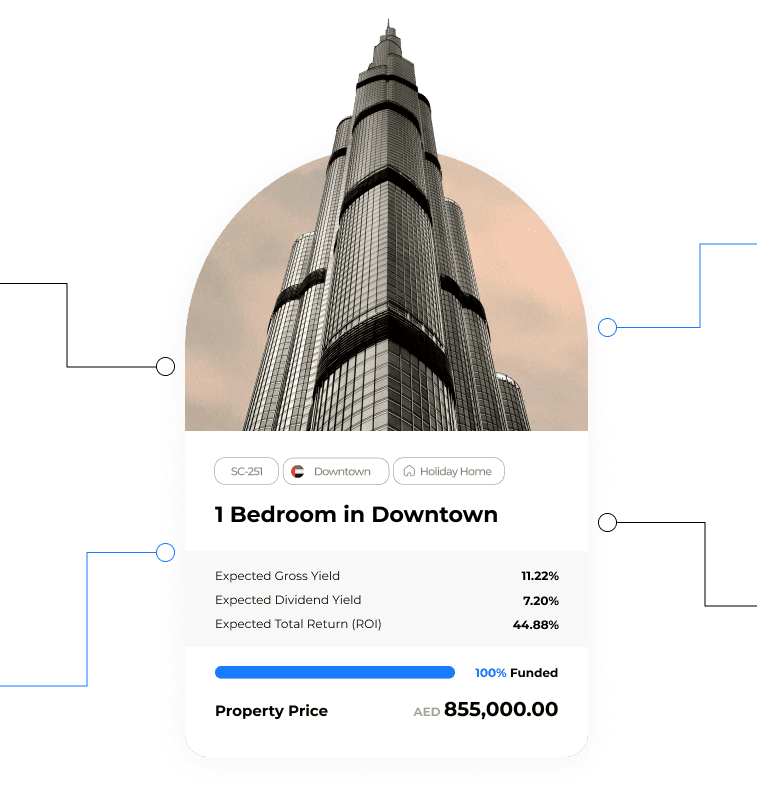

SmartCrowd Investments Structure employs an SPV that activates upon a property reaching full funding, bolstering your investment setup with enhanced security and transparency!

How SmartCrowd Investments Structure Works...

1. Property Listed

2. Funding Completed

3. SPV Created

4. Rental Income

1. Property Listed

2. Funding Completed

3. SPV Created

4. Rental Income

Property price

AED 1,000,000

Share price

AED 1.00

Your investment

AED 50,000

Shares you buy

50,000

Your total allocation

5%

As per the Dubai Land Department requirements, the SPV is incorporated and referenced in the public register of DIFC (Dubai International Financial Centre). It’s all regulated and more importantly, transparent!

Why do we use this structure?

To unify ownership on one title deed

To safeguard your investment

Frequently asked questions

SmartCrowd stands out for several reasons:

- Pre-vetted Opportunities: We carefully select each property investment opportunity before it reaches our platform. This ensures that every investment option meets our rigorous standards in terms of both quality and investment potential.

- Transparent Data: We believe in complete transparency. As a member, you’ll have access to institutional-level data and independent market valuations, empowering you to make informed investment decisions. Our commitment to transparency extends to fees, performance, and all the crucial information you need.

- Security: SmartCrowd is regulated by the Dubai Financial Services Authority (DFSA), providing you with peace of mind that your investments are safeguarded by industry standards.

- Accessibility: We are an entirely digital platform, making property investment accessible to a broader audience, meaning can invest from anywhere in the world, at any time.

- Diversification: With SmartCrowd, you can diversify your real estate portfolio effortlessly. Our platform offers a range of properties, allowing you to spread your investments across different property types and locations.

- Hassle-free Investing: The best part is that there’s no paperwork involved and zero property management required. You don’t even need to be a real estate expert!

Currently, RERA (Real Estate Regulatory Agency) cannot accommodate more than five to ten people on a property’s title deed. In order to accommodate multiple investors on a property title deed, SmartCrowd establishes one SPV for every investment property so that there isn’t a limit on the number of shareholders that can collectively invest in a property.

As an investor, you do! The property is legally owned by the SPV and you as a partial investor have shares in the SPV proportionate to your investment. You are the ultimate owner and beneficiary of the property proportionate to your investment amount.

Each property on SmartCrowd has its own corresponding SPV, whereby each SPV is broken into 1,000,000 shares. For ease of calculation, if a property is worth AED 1 million, each share in that property is worth AED 1. If an investor invests AED 500 – he/she owns 500 shares in that investment or 0.05% of the property. As per the Dubai Land Department’s requirement, this vehicle will be incorporated and registered in the DIFC (Dubai International Financial Centre).

The SPV corresponding to the property investment. Since it is not possible to list out dozens of names on a single title deed, the name issued on the title deed (ownership document) is that of the SPV corresponding to your property. Ultimately, you own direct shares in the SPV, which in turn is only responsible for holding the asset that is your investment property and paying out dividends to you.

To see your name as a shareholder, simply go on to the DIFC public register and type the name of the SPV that corresponds to your property. Typically the name of the SPV starts with the initials “SC” followed by a hyphen and a number.

This SPV is created as a separate company, with the sole purpose of acquiring and protecting the specific property, isolating it from any risks associated with SmartCrowd’s platform or other properties.

This arrangement shields investors from SmartCrowd’s liabilities and potential bankruptcy. The SPV is registered with the DIFC, and your ownership is documented in the public register. Additionally, it’s registered with the Dubai Land Department, providing a legal record of your property ownership through the SPV

If we don’t reach the funding goal in time, we’ll return your committed funds without any fees. You can then use those funds for another property or withdraw them from your SmartCrowd Account as you prefer.

When you initiate a withdrawal, we’ll send the funds back to the bank account you used to fund your SmartCrowd Account. Please note that SmartCrowd doesn’t allow for oversubscription at this time.

SmartCrowd stands out for several reasons:

- Pre-vetted Opportunities: We carefully select each property investment opportunity before it reaches our platform. This ensures that every investment option meets our rigorous standards in terms of both quality and investment potential.

- Transparent Data: We believe in complete transparency. As a member, you’ll have access to institutional-level data and independent market valuations, empowering you to make informed investment decisions. Our commitment to transparency extends to fees, performance, and all the crucial information you need.

- Security: SmartCrowd is regulated by the Dubai Financial Services Authority (DFSA), providing you with peace of mind that your investments are safeguarded by industry standards.

- Accessibility: We are an entirely digital platform, making property investment accessible to a broader audience, meaning can invest from anywhere in the world, at any time.

- Diversification: With SmartCrowd, you can diversify your real estate portfolio effortlessly. Our platform offers a range of properties, allowing you to spread your investments across different property types and locations.

- Hassle-free Investing: The best part is that there’s no paperwork involved and zero property management required. You don’t even need to be a real estate expert!

Currently, RERA (Real Estate Regulatory Agency) cannot accommodate more than five to ten people on a property’s title deed. In order to accommodate multiple investors on a property title deed, SmartCrowd establishes one SPV for every investment property so that there isn’t a limit on the number of shareholders that can collectively invest in a property.

As an investor, you do! The property is legally owned by the SPV and you as a partial investor have shares in the SPV proportionate to your investment. You are the ultimate owner and beneficiary of the property proportionate to your investment amount.

Each property on SmartCrowd has its own corresponding SPV, whereby each SPV is broken into 1,000,000 shares. For ease of calculation, if a property is worth AED 1 million, each share in that property is worth AED 1. If an investor invests AED 500 – he/she owns 500 shares in that investment or 0.05% of the property. As per the Dubai Land Department’s requirement, this vehicle will be incorporated and registered in the DIFC (Dubai International Financial Centre).

The SPV corresponding to the property investment. Since it is not possible to list out dozens of names on a single title deed, the name issued on the title deed (ownership document) is that of the SPV corresponding to your property. Ultimately, you own direct shares in the SPV, which in turn is only responsible for holding the asset that is your investment property and paying out dividends to you.

To see your name as a shareholder, simply go on to the DIFC public register and type the name of the SPV that corresponds to your property. Typically the name of the SPV starts with the initials “SC” followed by a hyphen and a number.

This SPV is created as a separate company, with the sole purpose of acquiring and protecting the specific property, isolating it from any risks associated with SmartCrowd’s platform or other properties.

This arrangement shields investors from SmartCrowd’s liabilities and potential bankruptcy. The SPV is registered with the DIFC, and your ownership is documented in the public register. Additionally, it’s registered with the Dubai Land Department, providing a legal record of your property ownership through the SPV

If we don’t reach the funding goal in time, we’ll return your committed funds without any fees. You can then use those funds for another property or withdraw them from your SmartCrowd Account as you prefer.

When you initiate a withdrawal, we’ll send the funds back to the bank account you used to fund your SmartCrowd Account. Please note that SmartCrowd doesn’t allow for oversubscription at this time.