SmartCrowd Investments Structure employs an SPV that activates upon a property reaching full funding, bolstering your investment setup with enhanced security and transparency!

SmartCrowd stands out for several reasons:

Currently, RERA (Real Estate Regulatory Agency) cannot accommodate more than five to ten people on a property’s title deed. In order to accommodate multiple investors on a property title deed, SmartCrowd establishes one SPV for every investment property so that there isn’t a limit on the number of shareholders that can collectively invest in a property.

As an investor, you do! The property is legally owned by the SPV and you as a partial investor have shares in the SPV proportionate to your investment. You are the ultimate owner and beneficiary of the property proportionate to your investment amount.

Each property on SmartCrowd has its own corresponding SPV, whereby each SPV is broken into 1,000,000 shares. For ease of calculation, if a property is worth AED 1 million, each share in that property is worth AED 1. If an investor invests AED 500 – he/she owns 500 shares in that investment or 0.05% of the property. As per the Dubai Land Department’s requirement, this vehicle will be incorporated and registered in the DIFC (Dubai International Financial Centre).

The SPV corresponding to the property investment. Since it is not possible to list out dozens of names on a single title deed, the name issued on the title deed (ownership document) is that of the SPV corresponding to your property. Ultimately, you own direct shares in the SPV, which in turn is only responsible for holding the asset that is your investment property and paying out dividends to you.

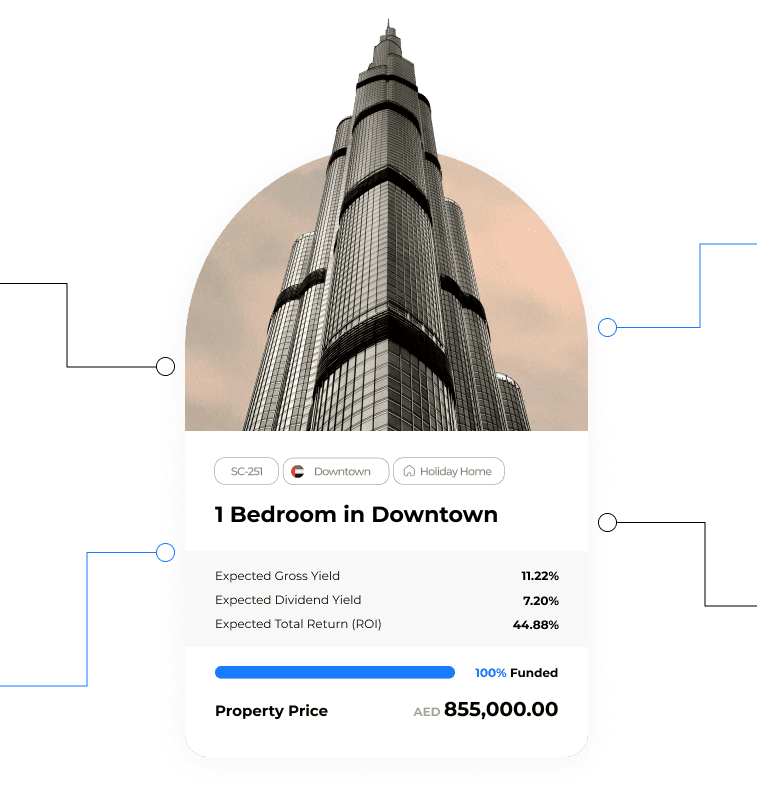

To see your name as a shareholder, simply go on to the DIFC public register and type the name of the SPV that corresponds to your property. Typically the name of the SPV starts with the initials “SC” followed by a hyphen and a number.

This SPV is created as a separate company, with the sole purpose of acquiring and protecting the specific property, isolating it from any risks associated with SmartCrowd’s platform or other properties.

This arrangement shields investors from SmartCrowd’s liabilities and potential bankruptcy. The SPV is registered with the DIFC, and your ownership is documented in the public register. Additionally, it’s registered with the Dubai Land Department, providing a legal record of your property ownership through the SPV

If we don’t reach the funding goal in time, we’ll return your committed funds without any fees. You can then use those funds for another property or withdraw them from your SmartCrowd Account as you prefer.

When you initiate a withdrawal, we’ll send the funds back to the bank account you used to fund your SmartCrowd Account. Please note that SmartCrowd doesn’t allow for oversubscription at this time.

SmartCrowd stands out for several reasons:

Currently, RERA (Real Estate Regulatory Agency) cannot accommodate more than five to ten people on a property’s title deed. In order to accommodate multiple investors on a property title deed, SmartCrowd establishes one SPV for every investment property so that there isn’t a limit on the number of shareholders that can collectively invest in a property.

As an investor, you do! The property is legally owned by the SPV and you as a partial investor have shares in the SPV proportionate to your investment. You are the ultimate owner and beneficiary of the property proportionate to your investment amount.

Each property on SmartCrowd has its own corresponding SPV, whereby each SPV is broken into 1,000,000 shares. For ease of calculation, if a property is worth AED 1 million, each share in that property is worth AED 1. If an investor invests AED 500 – he/she owns 500 shares in that investment or 0.05% of the property. As per the Dubai Land Department’s requirement, this vehicle will be incorporated and registered in the DIFC (Dubai International Financial Centre).

The SPV corresponding to the property investment. Since it is not possible to list out dozens of names on a single title deed, the name issued on the title deed (ownership document) is that of the SPV corresponding to your property. Ultimately, you own direct shares in the SPV, which in turn is only responsible for holding the asset that is your investment property and paying out dividends to you.

To see your name as a shareholder, simply go on to the DIFC public register and type the name of the SPV that corresponds to your property. Typically the name of the SPV starts with the initials “SC” followed by a hyphen and a number.

This SPV is created as a separate company, with the sole purpose of acquiring and protecting the specific property, isolating it from any risks associated with SmartCrowd’s platform or other properties.

This arrangement shields investors from SmartCrowd’s liabilities and potential bankruptcy. The SPV is registered with the DIFC, and your ownership is documented in the public register. Additionally, it’s registered with the Dubai Land Department, providing a legal record of your property ownership through the SPV

If we don’t reach the funding goal in time, we’ll return your committed funds without any fees. You can then use those funds for another property or withdraw them from your SmartCrowd Account as you prefer.

When you initiate a withdrawal, we’ll send the funds back to the bank account you used to fund your SmartCrowd Account. Please note that SmartCrowd doesn’t allow for oversubscription at this time.

SmartCrowd allows you to start investing in Dubai’s booming property market, build your own rewarding real estate portfolio, generate a passive income, and enjoy remarkable returns. Through SmartCrowd, you can reap all the benefits of direct real estate investments (i.e., by owning the properties) and reduce your risk by allocating your capital across a number of properties all through an award-winning digital platform.

RISK WARNING: Investments in property and unlisted shares carry a risk. Your capital may be at risk and you may not receive the anticipated returns. This is not investment advice. These estimates are based on past performance and current market conditions which cannot be regarded as an accurate indicator of future results. You should do your own due diligence or consult with an independent third-party advisor. Where Investment declines in value or is not repaid, you will still need to meet your repayment obligations. Please review the full set of risk disclosure.

Numbers and returns mentioned are of past performances and not indicative of the current market unless highlighted and promoted as such.

To provide the best experiences, we and our partners use technologies like cookies to store and/or access device information. Consenting to these technologies will allow us and our partners to process personal data such as browsing behavior or unique IDs on this site and show (non-) personalized ads. Not consenting or withdrawing consent, may adversely affect certain features and functions.

Click below to consent to the above or make granular choices. Your choices will be applied to this site only. You can change your settings at any time, including withdrawing your consent, by using the toggles on the Cookie Policy, or by clicking on the manage consent button at the bottom of the screen.