An investment in Dubai real estate through SmartCrowd is a great way to grow your wealth, but knowing how to exit an investment is just as important as getting in!

Whether you’re looking to free up capital or reallocate your funds, SmartCrowd provides two clear ways to exit a property investment in Dubai.

Let’s break them down so you can plan your exit with us, the smart way.

But First, What’s an Exit?

An exit in real estate investing simply refers to the process of selling or liquidating your investment to recover your funds. Just like entering an investment, exiting strategically is crucial to maximizing your returns.

At SmartCrowd, investors have two main exit options: selling shares through the Share Transfer Facility (STF) or participating in a full property sale. Understanding these options helps you make informed decisions that align with your financial goals.

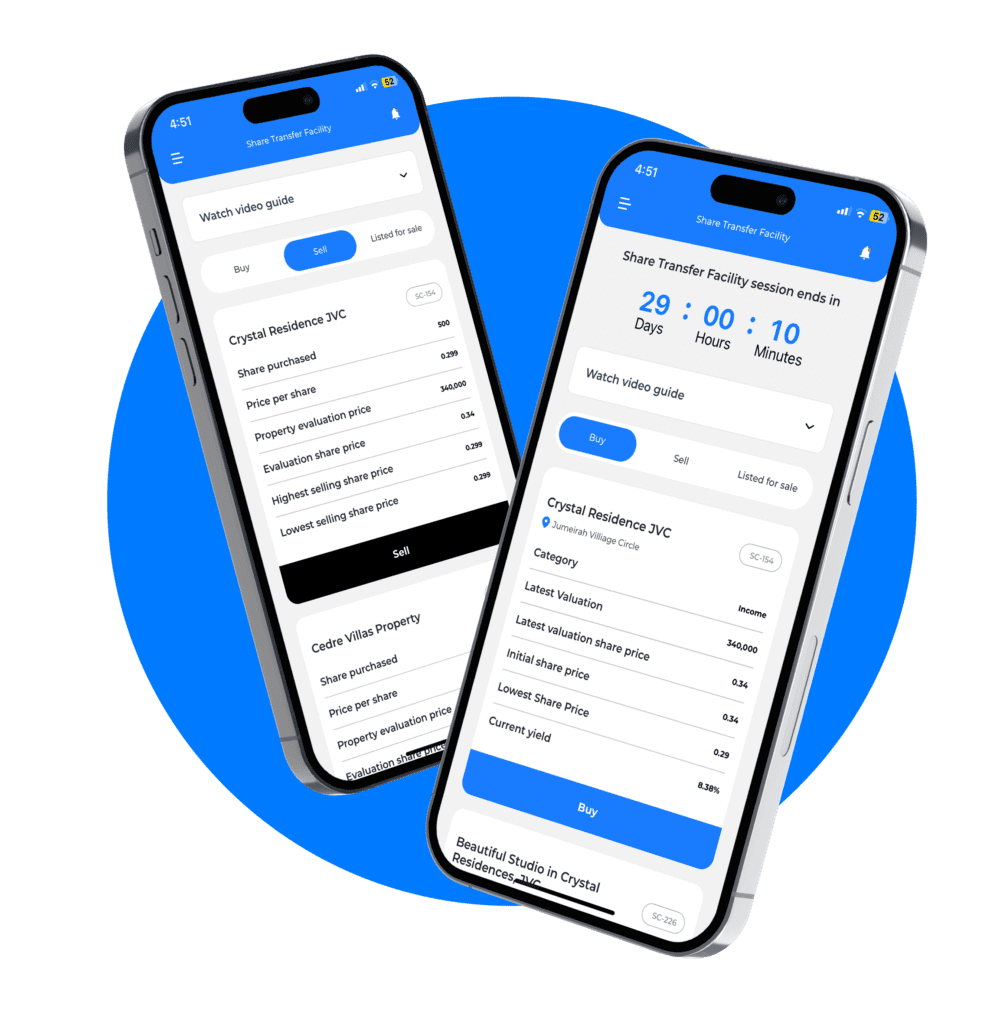

1. The Share Transfer Facility (STF): Your Personal Exit Strategy

If you’re looking to sell your shares in a property without waiting for a full sale, SmartCrowd’s Share Transfer Facility (or STF, for short) is your go-to option.

Here’s how the STF works:

- The Share Transfer Facility opens twice a year, in March and September, for two weeks each time.

- During this window, you can list your shares for sale to other investors on the platform.

- Property valuations are provided during this period to help you set an informed price.

- If another investor purchases your shares, you successfully exit the investment without needing a full property sale.

The best part is that this method offers flexibility and control, allowing you to exit on your terms while keeping the property investment active for other shareholders to benefit from.

However, since the sale depends on investor demand, there’s no guarantee that your shares will be sold within the given timeframe, so just keep that in mind.

2. Full Exit: Selling the Entire Property

A full exit happens when the entire property is sold. However, this isn’t a decision you make alone, it requires a majority vote from the property’s investors.

Here’s how our full exits work:

- SmartCrowd recommends holding a property for at least 5 years before considering a sale.

- If we receives a strong offer at the end of the holding period, we notify the investors of that property and ask if they would like to vote on selling it.

- A sale only goes through if the majority of investors agree to exit. This vote is based on the proportionate weighting of your investment, meaning that if you own 10% of the shares in a single property, your vote carries a 10% weight. We don’t allow anyone to own more than 24.99% of a property to ensure that no one is a controlling party.

- Property valuations are provided whenever a vote is initiated so investors can make informed decisions.

- Keep in mind, this vote can be called even sooner by SmartCrowd, or any of the investors for valid reasons (i.e. there’s opportunity to make a handsome profit).

This method ensures that investors have a say in whether to cash out their investment or continue holding for potential future gains.

Fun fact: Our average holding period is 3 years, with an average total net ROI of 42% (as of March 2025)!

So, What Happens After You Exit an Investment in Dubai?

Once you’ve successfully exited your SmartCrowd investment, what should you do next?

Let’s go over some smart options:

- Reinvest in Other Dubai Properties: Keep your money working for you by exploring new Dubai investment opportunities on SmartCrowd.

- Diversify Your Portfolio: Consider spreading your investments across different property types or even other asset classes, like stocks or bonds.

- Boost Your Savings: If you need liquidity, use the funds to strengthen your emergency fund or save for future opportunities.

Final Thoughts

Exiting a SmartCrowd investment in Dubai is a super straightforward process, whether you opt for the Share Transfer Facility or a full property sale. By understanding your options and planning ahead, you can make informed decisions that align with your own financial goals.

Whenever you’re ready to exit, SmartCrowd is here to support you with property valuations, investor opportunities, and a seamless transaction process. And remember, if you decide to reinvest, diversify, or cash out, the key is to exit strategically and confidently.

READ MORE: Reinvesting vs. Cashing Out in Dubai

Disclaimer: This blog is intended solely for educational purposes and shouldn’t be treated as financial advice. We suggest you always conduct thorough research, perform your own due diligence, and consult with financial advisors to assess any real estate property against your own financial goals.