Our Lake View studio in Jumeirah Lake Towers (SC 102) marks a significant milestone for us. It was actually the first real estate transaction on SmartCrowd, making SC 102 the first property to reach its five-year anniversary while embodying the success of investing in Dubai with us. Quite romantic, isn’t it?

Candles and rose petals aside, this is one of the most important exit tales you will read. In fact, it’s the most comprehensive case study on SmartCrowd, showcasing this property’s full five-year cycle in the Dubai real estate market, capturing all its ups and downs right from the very birth of our platform. 🐣

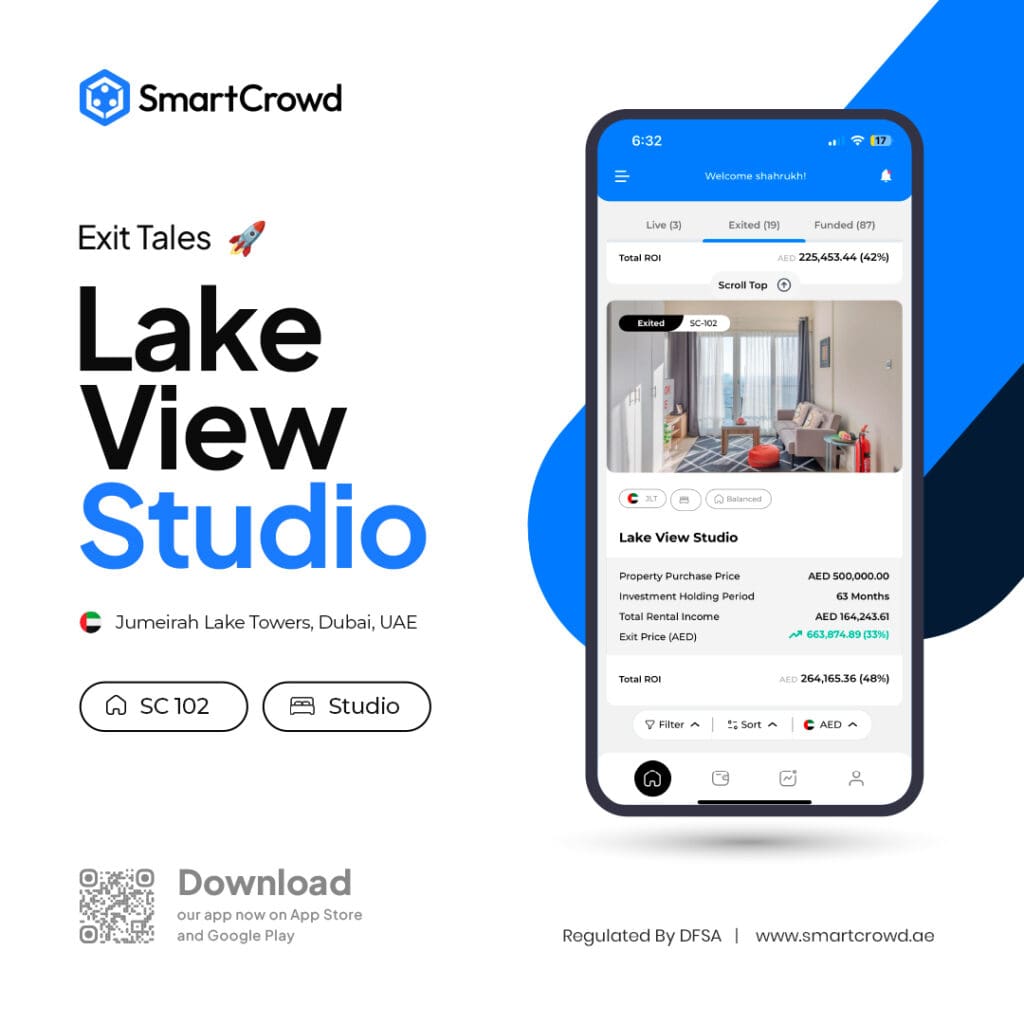

Check out our exit in Lake View, Jumeirah Lake Towers (JLT): SC 102. 👇

👀 Let’s Look at Lake View

SC 102 was a 420 sq ft studio located in the striking Lake View Tower in Jumeirah Lake Towers’ (JLT) Cluster B, and strategically positioned near the metro and an array of restaurants and cafés. The building had impressive views from each corner, be it the lush green lake community of Jumeirah Islands or stunning marina. This particular unit was overlooking the swimming pool from the 17th floor, with a partial lake view.

Nestled behind Dubai Marina, JLT is a bustling business hub that blends residential and commercial towers. Known for its four picturesque lakes, lush greenery, and vibrant recreational offerings, JLT offers a well-rounded lifestyle for all. Whether you prefer lakeside strolls, rooftop dinners, or skyline views at dusk – JLT is brimming with possibilities.

🐣 Our First SmartCrowd Unit

Let’s rewind to September 2018 – a more stable time for the Dubai real estate market before the rapid declines in the following couple of years, namely the challenges brought about by COVID-19. Purchased for AED 500,000, we had a long-term strategy in place for this Lake View unit. At that time, the property was rented for AED 55,000 per year.

However, the Dubai real estate market took a negative turn into 2019 and then the pandemic hit a year later. Soon after, the property faced a dip in both value and annual rent, reaching as low as AED 400,000 and AED 36,000, respectively.

🔄 Strategy Switch-Up

Despite these challenges, we adapted our strategy, transitioning from long-term to short-term and eventually back to long-term. Moreover, the beauty of long-term investments lies in their resilience, allowing us to hold through the market uncertainty that unfolded.

💸 Five Years Later

We successfully exited SC 102 for AED 690,000 (AED 663,874 net) this December after a 63-month holding period, yielding a gross profit of AED 143,000, or 26%, surpassing the initial investment cost of AED 546,000. Net capital gains amounted to AED 99,921, representing an impressive 18% return on the total cost.

Our proactive approach during market fluctuations resulted in a net income of AED 164,243, nearly 30% of the property’s total cost. Over five years, the property demonstrated an average annual capital appreciation of 4%, contributing to a total return of AED 251,447 (46%) with an annualized return of 8.76%.

💭 Key Takeaway

Despite the market challenges during the initial years of holding, our approach enabled investors to navigate through turbulent times. As you may know, we typically recommend a five-year holding period when investing in Dubai with SmartCrowd, and this specific case demonstrates the reward when committing to that. Here are the key lessons from SC 102:

- Remove Your Emotions: Limit emotions, avoid panic, and strengthen your ability to hold investments to optimize your returns, even when things seem awry.

- Diversify Your Portfolio: If life gives you lemons, diversify. This is your chance to rethink your strategy and spread your capital across multiple investments so you avoid overexposing yourself to a single asset.

- Stay Disciplined: The golden rule of smart investing – stay disciplined and invest for the long haul. It’s a mantra that pays off, especially in real estate.

And that’s a wrap for this Exit Tale. Don’t let this be the end, though. This is just the beginning of your Dubai real estate success. Explore our latest opportunities on the SmartCrowd platform and starting investing in Dubai – your portfolio might thank you later!

—

Disclaimer: This blog is intended solely for educational purposes and shouldn’t be treated as financial advice. We suggest you always conduct thorough research, perform your own due diligence and consult with financial advisors to assess any real estate property against your own financial goals.