Not sure when to start investing? Well, the best time would be now.

When it comes to growing your wealth, there’s one game-changing factor that often gets overlooked: time.

Starting early gives you a huge advantage, all thanks to the power of compounding. So, whether you’re dreaming of early retirement, saving for your future home, or simply looking to grow your money, the earlier you begin, the better your chances of achieving your goals.

In this blog, we’ll explore the benefits of investing early and show you how time can become your greatest ally in achieving financial freedom.

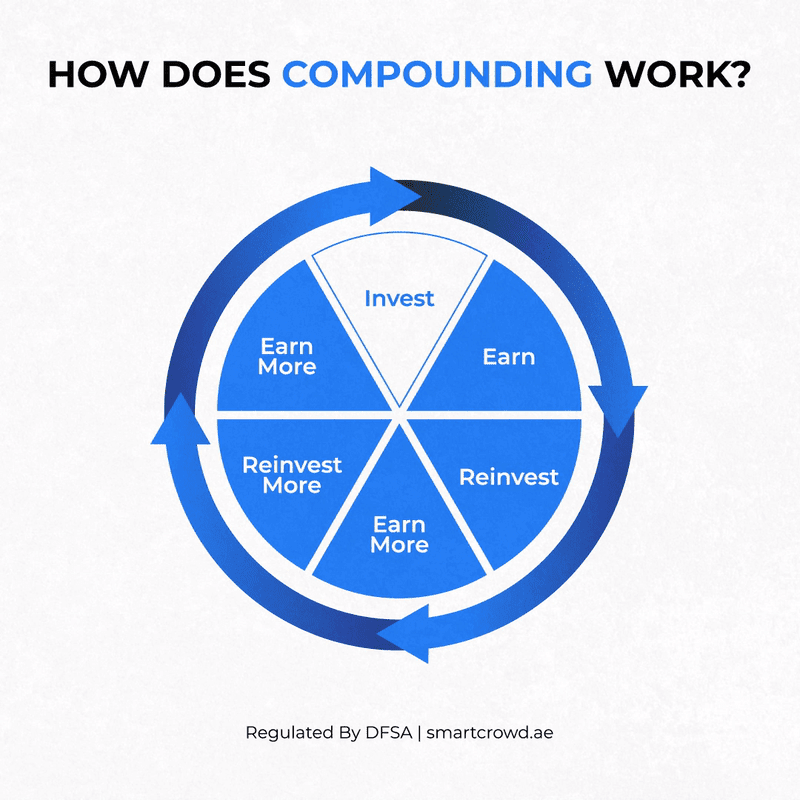

1. The Power of Compounding

Ever heard the phrase, “It’s time in the market, not timing the market”? This adage is a reminder of two things:

1. Historically, over long periods, markets have grown.

2. The earlier you invest, the more time compounding has to work its magic.

Essentially, compounding means you earn returns not just on your initial investment but also on the returns those investments generate. It’s like a snowball rolling downhill, growing bigger as it gathers more snow along the way.

Let’s paint a simple picture for you:

Imagine you invest AED 1,000 a month in a portfolio growing at an average annual rate of 8%.

- In Year 1, your investment grows by AED 960.

- By Year 2, growth applies to both your original AED 12,000 and the AED 960 from Year 1.

Over time, this compounding effect boosts your investments. The earlier you start, the more time you give your money to grow. It’s like planting a tiny seed and watching it bloom into a tree.

2. Greater Flexibility

Starting your investment journey early gives you one thing money can’t buy: peace of mind.

By building your wealth over a longer period, you won’t feel pressured to take big risks or scramble to save later in life. Instead, you can invest smaller amounts consistently and still achieve your financial goals.

Essentially, investing early gives you greater flexibility. Life is unpredictable, and having an investment cushion can make a big difference when unexpected expenses arise.

Whether you decide to take a career break, start a business, or pursue a passion project, starting early gives you the freedom to make choices without constantly worrying about your finances.

3. Developing Healthy Financial Habits

Investing early isn’t necessarily just about growing your money, it’s also about developing a mindset fertile for financial success.

By starting young, you build habits that can last a lifetime, such as:

- Consistent Saving: Learning to set aside a portion of your income every month.

- Budgeting: Understanding how to balance your spending and savings.

- Long-Term Thinking: Focusing on your future financial goals rather than short-term gratification.

These habits not only set you up for financial success but also help you navigate life’s many unexpected challenges with confidence.

4. You Can Afford to Take More Risks

As per the first benefit, one of the biggest advantages of starting early is that time is on your side. When you’re young, you have the luxury of taking on higher-risk investments, like stocks or real estate that have the potential for higher returns.

Even if the market dips or you make a mistake, you have plenty of time to recover. However, an investor who starts investing at a later stage in life will have less room (and time) to recover any losses. Thus with early investments, your investment gets more time to grow in value.

For example, real estate investments are often seen as a stable long-term option. Platforms like SmartCrowd make it easy to get started with fractional real estate investing, allowing you to spread your risk and invest small amounts across multiple properties in Dubai.

5. Achieving Financial Independence Sooner

Imagine reaching a point where you no longer need to work for money, you work because you want to. That’s the beauty of financial independence, and investing early can help you get there faster.

By putting your money to work early on, you create a steady stream of passive income that can cover your expenses. Whether it’s through rental income, dividends, or appreciation in value, early investments can give you the freedom to live life on your terms.

Wrapping Up

Investing early is one of the smartest financial decisions you can make. With the power of compound interest, the flexibility to take risks, and the opportunity to develop healthy financial habits, there’s no better time to start than now.

The good news? You don’t need a fortune to begin. Thanks to platforms like SmartCrowd, you can start small and gradually grow your investments over time. Remember, the key to building wealth isn’t timing the market – it’s time in the market.

So, what are you waiting for? Take that first step today, and your future self will thank you.

Disclaimer: This blog is intended solely for educational purposes and shouldn’t be treated as financial advice. We suggest you always conduct thorough research, perform your own due diligence, and consult with financial advisors to assess any real estate property against your own financial goals.