Big news for the UAE (and Disney fans everywhere): Disneyland Abu Dhabi is coming to Yas Island. Though there certainly isn’t a shortage of theme parks in the UAE, it’s Disney’s first in the Middle East and their seventh worldwide. Developed in partnership with Abu Dhabi’s Miral Group (the team behind Yas Island’s blockbuster attractions like SeaWorld and Warner Bros. World), this mega project is set to transform the region’s entertainment landscape.

But beyond the fireworks and fairytales, there’s something else brewing: serious investment potential. Here’s how Disneyland Abu Dhabi will be fueling the market, and why investors should be paying close attention.

All About Disneyland Abu Dhabi

While an official opening date has not been announced, the design phase is expected to take about two years, with construction potentially spanning up to five years. As the project progresses, more details about attractions, accommodations, and dining experiences will be revealed. Disneyland Abu Dhabi promises to offer a unique blend of magic and culture, creating unforgettable memories for visitors from around the world.

Where Disney Magic Meets Emirati Culture

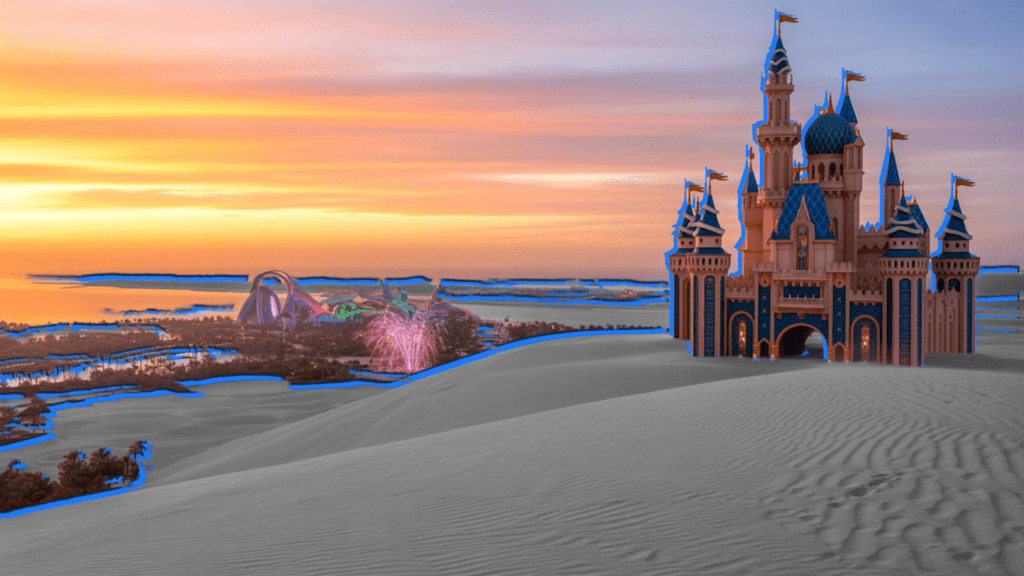

This won’t be a copy-paste Disneyland. From what’s been teased, the park will feature a castle inspired by Emirati architecture, complete with pearlescent spires that glow like a Gulf sunset. Expect a unique fusion of Disney storytelling and local heritage – something distinctly new, yet recognizably Disney.

Built for the Climate, Powered by Innovation

Considering Abu Dhabi’s year-round sun, the park is being designed with comfort in mind. Fully indoor attractions and climate-controlled spaces will keep the magic alive no matter the season, alongside next-gen immersive tech for that signature Disney wow factor.

While it’s fantastic news for families, it’s also a sign of the kind of forward-thinking development that drives real estate momentum.

Why This Matters for Your Portfolio:

1. Tourism-Driven Demand

With Disneyland joining Yas Island’s already impressive lineup of attractions, Abu Dhabi is poised to see a major uptick in tourism. That means more demand for short-term rentals, serviced apartments, and hospitality-focused real estate. Properties in proximity to the park will likely see higher occupancy rates and strong yields—especially from international visitors and regional staycationers.

2. Long-Term Economic Growth

Disneyland Abu Dhabi is expected to create over 30,000 jobs across construction, operations, and tourism-related services. This kind of large-scale employment leads to population growth, urban development, and infrastructure expansion, all key factors that drive long-term real estate appreciation. Additionally, Abu Dhabi’s tourism sector is projected to contribute AED 55 billion ($14.97 billion) to the emirate’s GDP in 2024, with ambitions to reach over AED 90 billion by 2030.

3. Boost to Yas Island and Surrounding Areas

Yas Island is already a success story. The addition of Disney cements its status as a global entertainment hub. That ripple effect will extend to nearby neighborhoods, from new residential communities to retail and dining developments. For investors, this means more choice and more opportunities to get in early on high-growth areas.

4. Government Backing and Vision 2030

The UAE’s Vision 2030 isn’t just about diversification, it’s about building a resilient, future-ready economy. Projects like Disneyland don’t happen in isolation; they’re part of a broader strategy to turn Abu Dhabi into a global tourism and investment powerhouse. That means continued policy support, infrastructure investment, and a favorable environment for real estate growth.

Disneyland Abu Dhabi In Short

At SmartCrowd, we see this as a magical yet strategic signal. Major developments like Disneyland have a ripple effect on surrounding real estate in Abu Dhabi and Dubai. Increased foot traffic, new hospitality and retail ventures, and growing demand for residential units all contribute to rising property values.

Want in?

Our real estate crowdfunding platform makes it simple to invest in high-potential properties in the UAE, without needing millions upfront. Through fractional real estate investing, you can own a slice of the UAE’s future and benefit from the region’s booming tourism economy.

Explore all the latest investment opportunities now!

Disclaimer: This blog is intended solely for educational purposes and shouldn’t be treated as financial advice. We suggest you always conduct thorough research, perform your own due diligence, and consult with financial advisors to assess any real estate property against your own financial goals.