This exit tale isn’t just another story – it’s our 25th exit, and boy, did it deliver! With over 100% ROI, we couldn’t be more excited to share the outcome of when you invest in Dubai real estate. Now, we know what you’re thinking: “25th Exit? Over 100% ROI?” Yes, it’s a lot to take in, but we’ll happily walk you through it in our latest Exit Tale which took place in Al Waha (Dubailand)!

Al Waha Whereabouts:

Al Waha is a modern gated villa sub-community within Dubailand’s many sub-districts, built in a modern Mediterranean style. Essentially, it’s a residential project offering idyllic villas that lie along Emirates Road (E611), with easy access to Dubai Investments Park and the upcoming Al Maktoum International Airport.

Part of the Shorooq and Al Layan developments, known for their family-friendly environments and well-developed outdoor landscapes, this 1,824 sq ft unit was a spacious two-bedroom townhome with a living/dining area, two bathrooms, and private parking on the ground floor with access to the backyard. Moreover, this unit is part of a unique, self-contained layout, offering four townhomes, two at the bottom and two at the top.

🎯 Smart Strategy:

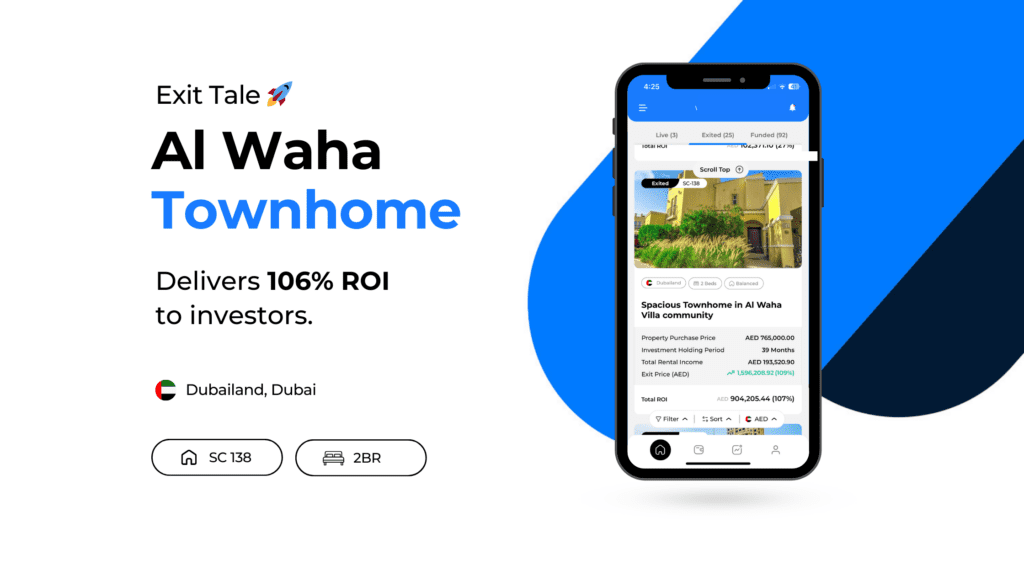

We saw the potential in Al Waha early on. The investment property was purchased for AED 765,000 by 84 investors in February 2021 during the COVID pandemic, when the Dubai real estate market was beginning to recover and demand for villas and townhomes was on the rise. Additionally, service charges were notably low for the unit at the time, which made for an incredibly attractive opportunity to invest in Dubai. Moreover, being one of the largest two-bedrooms across Dubai real estate, this unit stood out to renters and potential buyers looking to invest in Dubai, and it was eventually sold for AED 1,650,000 in May 2024!

🏆 Record-Breaking Returns:

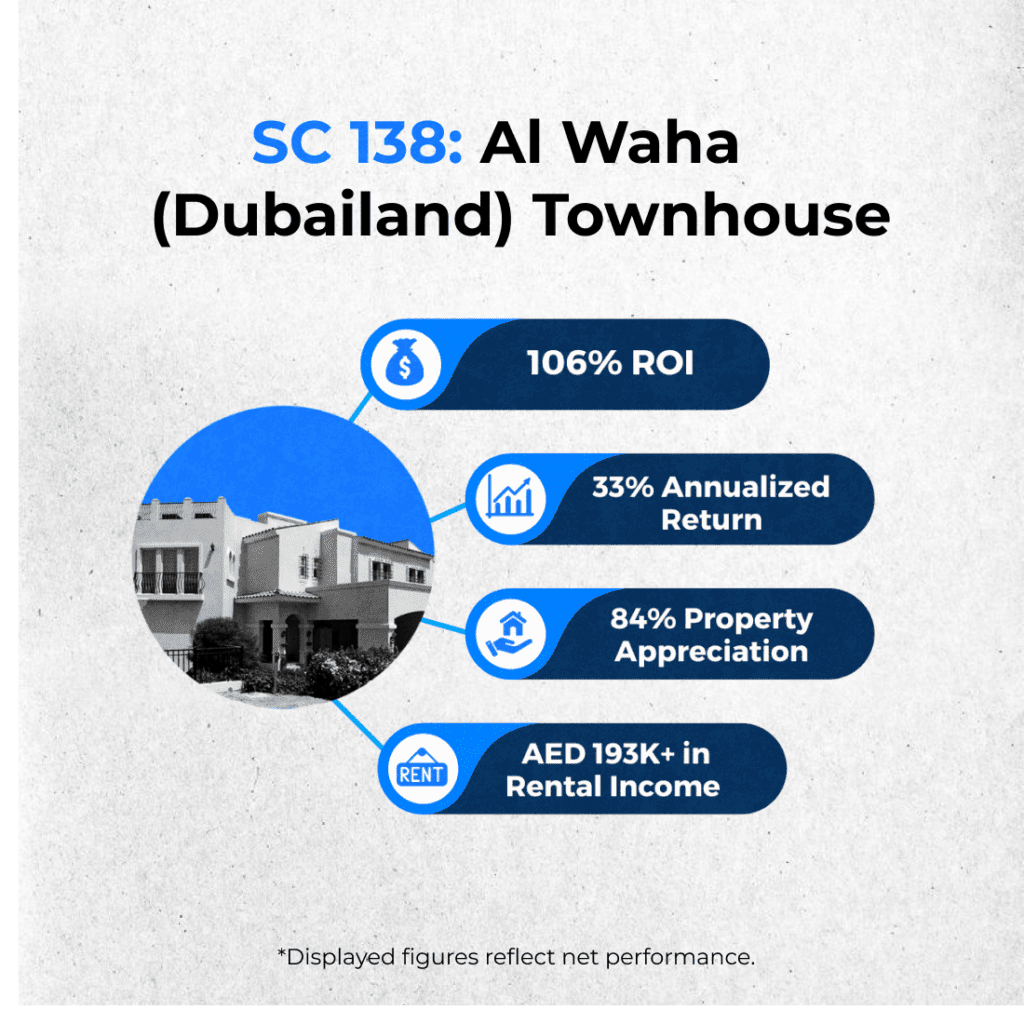

Over three years, this investment property pulled off the ultimate feat, generating a record-breaking return on investment of 106%, meaning investors actually doubled their money! While investments in mature real estate markets might take a decade or more to double up, this one did it in just three years.

The unit itself generated AED 193,000 in net rental income that was distributed to all the investors, which is effectively 25% over three years. With a net capital gain of about 84%, the annualized return stands at approximately 33%, which is exceptional.

🚀 Key Takeaway:

This exit in particular hit two major milestones for us. This was our 25th exit, which just so happened to deliver over 100% ROI to its investors – and that’s a win-win if we ever saw one! Here are our key SC 138 highlights:

- Do Your Homework: Despite tough times during COVID-19, investing in Al Waha was a smart move as the market was bouncing back, with villas and townhomes more in demand than ever, so this opportunity was a no-brainer.

- Buy Low, Sell High: We bought low when the market was recovering, keenly observed market trends, and then sold high at the perfect moment in May 2024, maximizing returns for our investors.

- Smart Moves: As you’ve just seen, selling the investment property in May 2024 resulted in huge profits. Investors doubled their money in just three years, which is just remarkable. Through our fractional ownership model and Dubai real estate expertise, we’ve continued to provide unmatched opportunities for investors to realize phenomenal returns!

And that’s a wrap! We hope to continue motivating all our clients to invest in Dubai, as well as delivering record-breaking returns to our SmartCrowd investors. Stay tuned for more Exit Tales. 🚀

Check out our current opportunities here.

Disclaimer: This blog is intended solely for educational purposes and shouldn’t be treated as financial advice. We suggest you always conduct thorough research, perform your own due diligence and consult with financial advisors to assess any Dubai real estate property against your own financial goals.