Market activity has picked up in Dubai while changing conditions have led to a shift in customer preference. People are demanding more space and better value, which has led them to explore their options within the Villa and townhome market. With both property prices and rental costs coming down, it presents an excellent opportunity for individuals to upgrade or finally consider buying a villa property of their own in Dubai. Practically in the current environment, you are getting” the best bang for your buck.”

Villas also make financial sense as the cost of carrying them is much cheaper comparatively. On average, service charges for apartments range from AED 10-20 per sqft, whereas villas are only AED 2-6 per sqft. For investors, it only accounts for 8-12% of the potential rent compared to 20-30% for apartments, which means more money in your pocket if you’re a villa investor compared to apartment investors.

Over View of Dubai Villa Space

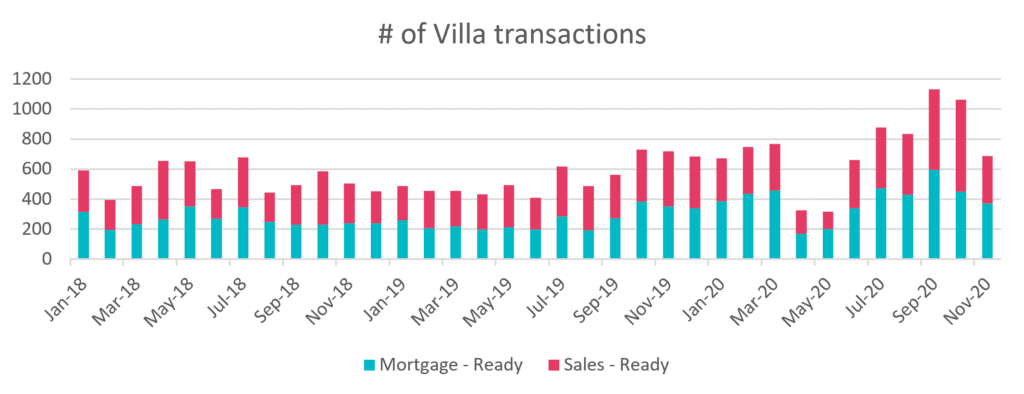

Let’s look at the numbers; through the pandemic, we have witnessed a stark increase in villa transactions. Since June 2020, we have experienced an average of 65% increase in volume compared to last year. Mortgage transactions have seen a rise of 94%, almost double the volume during the same period the previous year. Even when compared to 2018, the volumes are substantially up. Villa transactions were improving in 2019, particularly the second half, and they would have if we were not hit with the pandemic. As you can see below, January and February 2020 saw increased momentum, but things starting to slow down from march onward until June, understandably due to lock down and travel restrictions.

The increase in mortgage transactions is a very positive sign. It demonstrates more end users are buying, which will help stabilize the market as long-term buyers or investors are displaying confidence to invest in real estate.

The total value of transactions is also up with the volume. With increased demand and limited supply, prices are expected to increase in the future. We saw recovery indicators in the second half of 2019, but things got delayed as a new variable was introduced- the pandemic. The facts mentioned point to a renewed demand in the market, as investors and end-users are starting to take advantage of the value in front of them. The off-plan market is taking a back seat as people prefer to purchase ready inventory.

The median prices for villas appear to be stabilizing, with the majority of the mortgage transactions occurring in mature communities like Springs, Meadow & Arabian Ranches. We are witnessing subtle price increases as people borrowing are also willing to spend more due to the low cost of borrowing and the government’s fundamental policy changes. It’s simply the notion of supply and demand that drives up prices in an increasingly competitive market.

However, the data suggests that not all communities are created equal. The newer developments continue to face challenges as most of those were sold off-plan only a few years ago at peak prices, and the current prices in the secondary have not recovered to the purchase price. Older communities that are mature and fully developed show significant recovery signs as they are perceived to have better value and more substantial upside in the long term.

As Per Dubai Land department transaction data, the Waha community had the best price to performance ratio among villas in 2020. There were limited transactions in the community, indicating current occupants favored the lifestyle, which led to buyers not having the opportunity to purchase at drastically reduced prices. Other areas showing signs of recovery in the last quarter are Arabian Ranches I, District One, JVC, Mudon, Meadows, and Springs.

It appears the worst is behind us, and we are on the path to a gradual recovery. As the global macro situation improves with significant progress towards vaccine development and increased investor confidence, we expect to see more demand in the villa market that will continue to drive the prices upwards.

Spacious Townhome in Al Waha Villa Community

Min Inv: AED 5,000

Net Yield: 7.74%

View Investment