Dubai’s towering skyscrapers and world-class lifestyle have always beckoned property investors from far and wide. However, the high entry point often reserved real estate for the ultra-wealthy, which can be rather challenging when you’re looking to make an investment in Dubai.

But what if you could own a piece of Dubai real estate without really breaking the bank? Well, that’s what fractional property investment is all about!

So, what exactly is fractional property investment? What are the benefits? And is it worth it? In this blog, we take a look at fractional property investment in Dubai and how getting just a slice of the action could mean both a promising and lucrative opportunity for you.

Fractional Property Investment In Brief

Traditionally, investment in Dubai properties meant significant upfront costs. This essentially limited the pool of potential investors and instead concentrated property ownership. In short, fractional ownership means that you own portions of an asset, proportionate to the amount you have invested.

Let’s Simplify It For You…

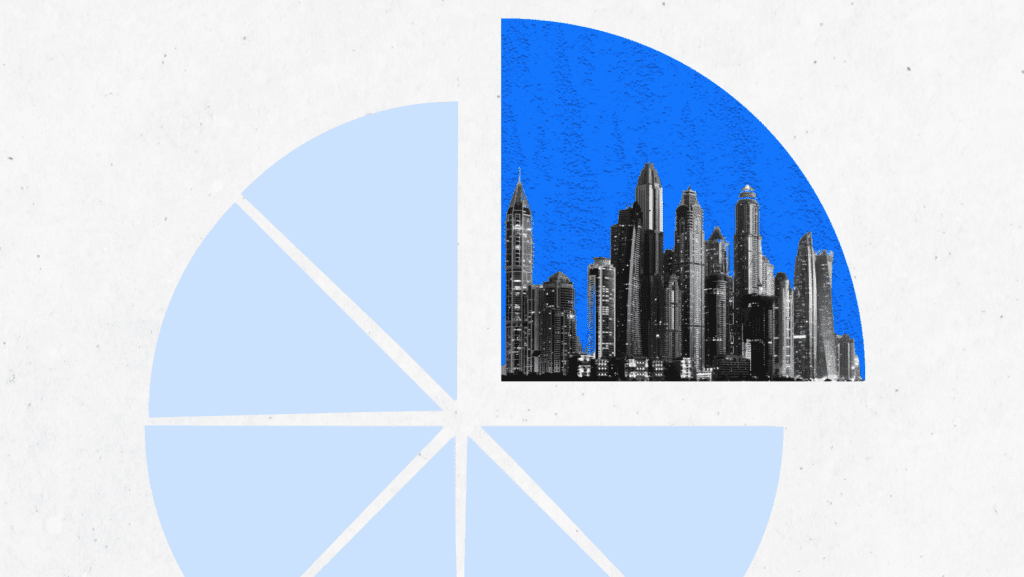

If we imagine an entire pie as a whole property or asset, fractional shares are simply slices of that pie. That same pie can be divided into a few slices (think quarters), several slices (think eighths), or even more depending on the amount you’re looking to invest (or devour)!

Now, whether you purchase the whole pie or just a few slices – that pie would taste the same, right? Essentially, when investing in fractional shares, you’ll still receive the benefits of investing in a whole asset, only at a lower purchase price – and this model applies to many asset classes, like stocks, cryptocurrencies, and real estate. In fact, fractional shares have come a long way, as they were traditionally available only during dividend reinvestment plans (DRIPs), stock splits, mergers, and acquisitions.

How Does Fractional Property Investment Work?

Let’s use our real estate crowdfunding platform, SmartCrowd, as an example here. After a property is listed and fully funded on the platform, SmartCrowd creates a Special Purpose Vehicle (SPV) acting as a separate company for investors to become shareholders in it. Each SPV is then divided into one million shares and investors are allocated shares proportionate to their investment. So, if a one-bedroom apartment in Jumeirah Village Circle (JVC) costs AED 1 million, then each share of that particular property is worth AED 1. That is to say, if an investor invests AED 20,000, then he/she owns 20,000 shares or 2% of the property. Simple enough, right?

So, fractional ownership in a nutshell has shattered the barrier once associated with real estate investment. Here’s how:

- Shared Investment: Through real estate crowdfunding, you invest in a portion of a high-end property alongside other investors. This drastically lowers the initial investment minimum, making Dubai’s prime real estate accessible to a wider group of individuals. In short, fractional shares allow you to own shares and build a portfolio that you would not be able to afford without fractional property investment.

- Diversification is Key: By owning shares in multiple properties across Dubai’s booming property market, you avoid putting all your eggs in one basket. Fractional ownership allows you to spread your investment across various properties, minimizing risk and potentially maximizing returns.

- Hassle-Free Management: Unlike traditional ownership, fractional ownership lets you reap the benefits without the burden of property management. Real estate crowdfunding platforms, like SmartCrowd, handle all the admin work and property management, so you don’t have to.

Is Fractional Ownership Better?

In short, it can be. And it’s down to a few reasons:

- Targeted Returns: When sourced by real estate companies like SmartCrowd, fractional ownership often focuses on properties with high rental yields and return outlook. This translates to a steady stream of income for you, making it an attractive option.

- Liquidity Like Never Before: Dubai’s fractional ownership market is becoming increasingly liquid. Many real estate crowdfunding platforms allow you to easily buy and sell your shares through share transfer windows, providing greater flexibility compared to traditional property investments.

- Invest Like a Pro: New to the Dubai real estate scene? Fractional ownership allows you to invest with regulated platforms that truly understand the market. This can be game-changing for navigating the market and maximizing your returns when you’re still starting out.

Is Fractional Ownership Right for You?

Despite its many benefits, fractional ownership isn’t a one-size-fits-all solution. So consider the following:

- Investment Goals: How much are you willing to invest? Are you seeking steady rental income, capital appreciation, or both? Think about your investment goals and what you aim to achieve through making a fractional investment.

- Risk Tolerance: While diversification mitigates risk, fractional ownership still involves the typical real estate risks associated with making an investment in Dubai.

- Exit Strategy: Are you willing to hold for 5 years? Understand your investment timeframe for exiting your investment and choose a platform with clear exit options.

The Future is Fractional

Hassle-free and accessible, fractional ownership is undeniably democratizing Dubai’s real estate market. So, are you ready to unlock your share of Dubai through fractional property investment?

In fact, it’s never been easier to invest in Dubai. You can get started right now with our real estate crowdfunding platform, SmartCrowd. So, go on, be part of our ‘SmartCrowd’. Gain exposure to Dubai real estate and diversify your portfolio with ease. 😉

Disclaimer: This blog is intended solely for educational purposes and shouldn’t be treated as financial advice. We suggest you always conduct thorough research, perform your own due diligence and consult with financial advisors to assess any real estate property against your own financial goals.