When we look at Dubai, we see the glittering lights, the towering skyscrapers, and the luxury lifestyle – but what about the numbers? If you’re looking to invest in Dubai real estate, it’s essential to consider just how good of an opportunity it is compared to other major global cities.

In fact, Dubai, merely a handful of roads in the 1960s, has truly taken the world by surprise over the last couple of decades, with the construction of iconic landmarks, such as the Burj Khalifa and the Dubai Frame. At present, Dubai has transformed into a global hub for business and innovation, ranking as a top city in various categories worldwide, from tourism to finance.

In this blog, we look at the facts and figures to compare Dubai with its counterpart cities in terms of rental yield, property price, and other critical factors when making a real estate investment.

Why Invest in Dubai?

- Higher Rental Yield

Dubai boasts one of the highest rental yields worldwide, with an average gross rental yield ranging between 6% to 10%. This is significantly higher when compared to cities like London and New York, where rental yields are typically lower at around 4% and 5%, respectively (Source: Global Property Guide). Be it a long-term rental or holiday home, this factor alone makes Dubai real estate an attractive option for investors looking for solid and consistent returns.

- Affordable Prices

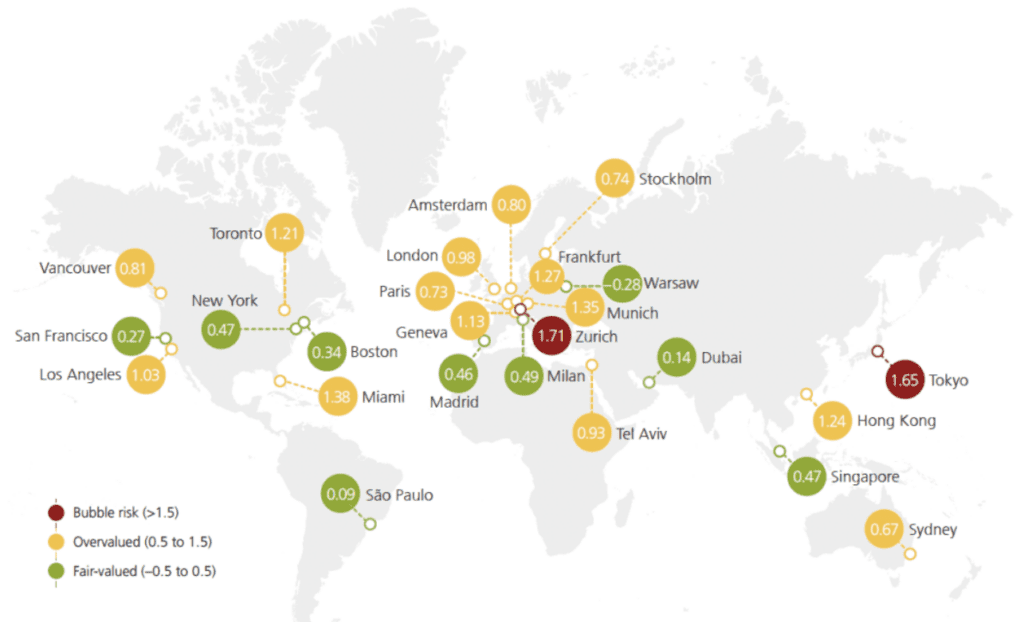

Renowned for its affordability, Dubai offers a safe haven for real estate investors. Unlike cities prone to overvaluation, the UBS Global Real Estate Bubble Index classifies Dubai (along with San Francisco and São Paulo) as having “fair value” properties. This contrasts with Zurich, Tokyo, or Miami, considered “at risk” by the index. With $1 million, one can acquire approximately 105 square meters of property in Dubai, significantly more than what the same amount would fetch in Monaco, New York, London, or Berlin.

According to a Knight Frank report, the average price per square meter of luxury property in Dubai is around $3,850, while in London it is around $19,350, in New York around $22,850, and in Hong Kong around $28,300. So, for the same budget, one can buy a much larger and more luxurious property in Dubai than in other major cities.

- Low Transaction Costs

Dubai boasts some of the world’s lowest property-related expenses, amounting to less than 10% of the purchase price. This attractive cost structure adds to the potential return on investment in Dubai real estate, ultimately giving you a bigger bang for you buck and maximizing your profit.

- Capital Appreciation Potential

Despite the challenges posed by the pandemic, Dubai’s prime residential market is projected to continue growing in 2024. While growth may be slightly lower than the previous year, it remains an attractive investment opportunity.

In 2023 alone, residential properties in prime Dubai areas rose in value by 17.4%, outpacing the global average of just 2.2%. This is a major game-changer for those looking to invest in Dubai, as even with rising prices, the city remains relatively affordable when compared to other cities and is more likely to result in a greater return on investment overall.

- Investor-Friendly Environment

Besides Dubai being a tax haven for property investors, with no income tax and zero property tax, it’s also an incredibly diverse, transparent, and regulated market. The Dubai government has continued to support an investor-friendly environment by consistently implementing regulations and attractive initiatives for investors globally.

Not to mention, the Golden Visa is a huge benefit for international buyers looking to secure Dubai investment properties, as they can purchase Dubai real estate for AED 2 million ($545,000) to get a 10-year Golden Visa. Otherwise, they can purchase a property for AED 750,000 ($204,000) to get a 2-year residence visa.

Wrapping Up

While real estate markets around the world offer unique opportunities and challenges, Dubai stands out as a great option for those looking to invest in a second home or a property for rental income. The Emirate offers low property prices, high rental yields, and a growing market that attracts any international property investor. The best part is, you hardly even need $1 million to spare if you want to invest in Dubai real estate.

If you’re ready to add some Dubai investment properties to your portfolio, then check out SmartCrowd! In fact, investing in Dubai real estate with a property crowdfunding platform like SmartCrowd can significantly improve your investment journey.

With our fractional ownership model, we simplify the buying process, ensuring a smooth, accessible, and hassle-free experience for anyone looking to invest in Dubai. Check out our expertly selected listings, which include a range of residential short-term and long-term rental opportunities. Who knows, your ideal Dubai investment property might be on the platform!

Find out which areas in Dubai generate the highest rental yields in our recent blog.

Disclaimer: This blog is intended solely for educational purposes and shouldn’t be treated as financial advice. We suggest you always conduct thorough research, perform your own due diligence, and consult with financial advisors to assess any real estate property against your own financial goals.